Tackling Climate Risk, Financial Modelling

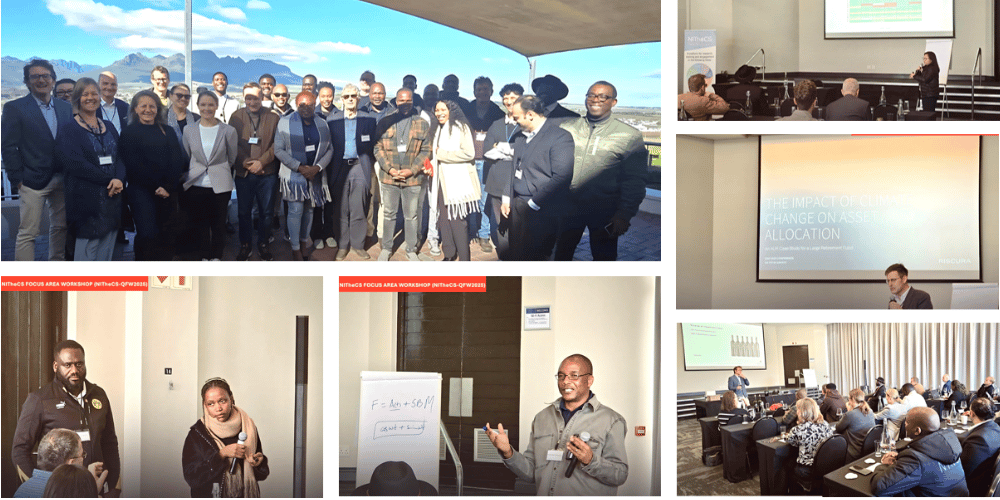

The II Workshop on Quantitative Finance, hosted at the Protea Hotel Techno Park in Stellenbosch, took place from 14–18 July 2025. It brought together leading scholars, policymakers, and industry experts to explore the intersection of sustainability, climate-related risks, and innovative financial modelling.

Organised by NITheCS Associate Prof Mesias Alfeus (Stellenbosch University), the event was supported by NITheCS. The Institute’s Director Prof Francesco Petruccione opened the workshop with a vision to position Africa as a global hub for cutting-edge research in computational finance.

Bridging Academia, Policy and Practice

NITheCS’s five-year roadmap places strong emphasis on aligning academic research with policy structures. A keynote session by Mr Bheki Hadebe (DSTI) affirmed this strategy, showing how NITheCS embeds government-funded initiatives into its research platforms – particularly in areas like climate risk, benchmark reform, and sustainable investing. This structural support ensures that advanced quantitative methods are channelled into practical, real-world policy applications.

Rethinking Pricing Models: The Benchmark Approach

In a stimulating mini school, Prof Eckhard Platen introduced the benchmark approach, an alternative to traditional risk-neutral pricing. Grounded in the growth optimal portfolio (GOP), this framework offers insights into information efficiency, market scaling laws, and a novel neutral interest rate. These ideas not only reframe financial theory but also have immediate relevance for the ongoing benchmark transition in South Africa.

JIBAR to ZARONIA: The Technical Path to Reform

The South African Reserve Bank (SARB) mini school, led by Mr Zakhele Gininda and Mr Naweed Hoosenmia, walked participants through South Africa’s move from JIBAR to ZARONIA. It focused on practical issues like data infrastructure, curve construction, and fallback provisions. The sessions revealed that benchmark reform is as much a systems engineering task as a financial modelling one, prompting robust debate on implementation strategies.

Climate Risk Modelling: from Global Systems to Local Portfolios

A full day was dedicated to climate risk. Prof Matheus Grasselli showcased how machine learning can simplify high-dimensional climate–economic models, enabling faster policy simulations. Meanwhile, Dr Petri Greeff illustrated how climate scenarios influence pension fund allocations, and Prof Rüdiger Kiesel used stochastic methods to stress test financial systems under various net zero pathways. Together, these talks underscored the urgent need for integrated models linking macroeconomic policy, climate science, and portfolio management.

Beyond the Conventional: Wine as an Asset Class

Midweek, delegates explored fine wine as an innovative investment. Prof Alfeus presented the SAFW10 Index, showing how top South African wines offer diversification during market stress. Mr Roland Peens described a new Bond Wine AMC product—an ISIN-listed fine wine investment vehicle – demonstrating the real-world viability of alternative assets. A live tasting, courtesy of Glenelly and The Stellenbosch Reserve, lent a sensory dimension to the day’s theory.

Cutting-edge Research and Youth Engagement

More than 30 short presentations spanned topics from tail risk indices and generative AI for volatility modelling to default risk under IFRS 9 and environmental policy games. These talks confirmed that modern finance increasingly draws from data science, machine learning, and complex systems theory.

The closing session by Mr Johannes Meyer highlighted efforts to expand the pipeline of future financial scientists through gamified outreach programmes targeting high school learners – a fitting finale to a week focused on innovation and sustainability.

Looking ahead

The workshop left three key takeaways:

- Interdisciplinary collaboration between academia, government and industry is essential for sustainable finance innovation.

- Holistic modelling pipelines – from macroeconomic forecasts to portfolio-level implementation – are now both possible and necessary.

- Institutional partnerships such as the NITheCS–CQF alliance and an upcoming special issue of the International Journal of Theoretical and Applied Finance (IJTAF) ensure ongoing research impact and dissemination.

Next steps include:

Participation in the InSPiR2eS Global Pitching Research Competition 2025 (Stellenbosch Chapter)

Submissions to the IJTAF special issue on Quantitative Finance by 15 October 2025.

The next workshop is scheduled for 22–26 September 2025 at Stellenbosch University.